KARACHI: Pakistan’s central bank governor on Monday said the current account would show a “substantial” surplus this year through June mainly on the back of a record inflow of remittances which crossed the $4 billion mark in March, with Saudi Arabia once again topping the list of biggest contributors.

Pakistan received a record-high $4.1 billion in remittances in March 2025, which bodes well for the government’s efforts to revive an economy that it expects will expand three percent this year, State Bank of Pakistan (SBP) governor Jameel Ahmad said at an event at Pakistan Stock Exchange in Karachi.

The central bank had earlier projected economic growth to range from 2.5 percent to 3.5 percent.

“With this level of remittances, we are hoping that for the current fiscal year our current account will stay in surplus,” the governor said. “There will be a substantial surplus and this surplus is the best performance, I will say, on the external account during the last two decades.”

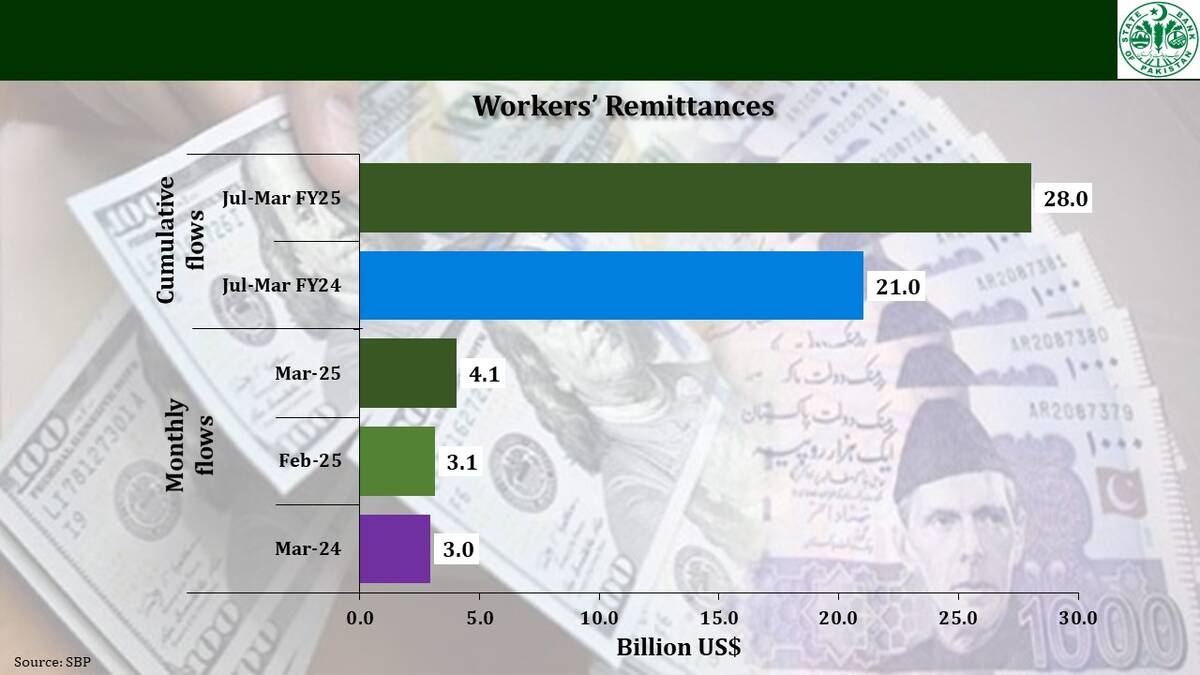

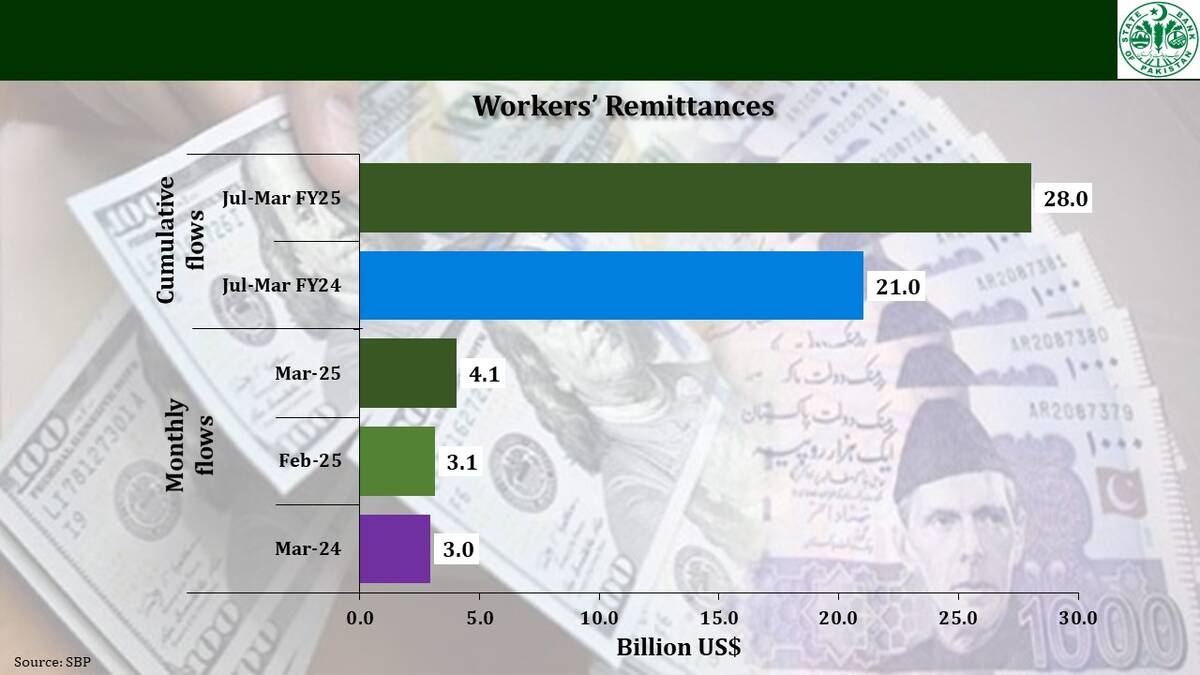

The country broke its own record in February when overseas Pakistanis remitted $3.1 billion.

Pakistan has faced a serious shortage of dollars and had to restrict imports in 2023 to avoid an imminent default on its foreign debts, which was avoided with the help of a last-gasp $3 billion financial bailout from the International Monetary Fund (IMF).

Prime Minister’s Shehbaz Sharif’s government is now waiting for the IMF’s executive board to approve the next $1 billion tranche of a new program, approved in September last year, to boost foreign exchange reserves that currently stand at $10.6 billion.

The current trend in the worker remittances inflows, Ahmad said, had made the central bank revise its earlier projection of $36 billion to $38 billion for this financial year. On the basis of such healthy inflows, the country’s foreign exchange reserves were expected to surge beyond $14 billion this year.

Ahmad said the country had paid most of its external debt for FY25 and was expected to receive as much as $5 billion from external sources by the end of June.

“I am quite confident that we will be receiving $4 to $5 billion before the end of June this year,” he said, without mentioning the exact source of these funds.

Pakistan’s total debt liabilities this year amounted to $26 billion of which $16 billion was supposed to be rolled over or refinanced, the governor said. Of this, he said, $3.7 billion debt was refinanced while close to $12.4 billion has been rolled over by friendly countries including China, Saudi Arabia and the UAE.

Out of the remaining $10 billion debt, Pakistan has already repaid $8 billion and was required to repay only $2 billion in the remaining months of this year.

“We have been servicing all those debt obligations on time,” said the SBP governor, adding that some inflows were delayed, but these would also come before June 30.

Jameel said Pakistan’s current account was stable and showed a $700 million surplus this year through February. Last year, the country’s current account showed $1.7 billion, close to half percent of GDP.

“Good thing is that we have been able to achieve this surplus despite substantial increase in imports,” he said, rejecting the claims that the government was still restricting imports.

Pakistan was also spending around $5.7 billion every month on oil and non-oil imports.

Due to the current account surplus and other policy and regulatory measures like exchange companies’ reforms, the Pakistani rupee had stabilized.

“The gap between the interbank market and the open market is very narrow,” Ahmad said.

While the economy was expected to grow three percent this year compared with 2.5 percent last year, agriculture was a major drag on economic expansion this year and rose less than one percent during the first six months through December.

Otherwise, he said, the economy was “doing well.”

“You can see the economic activity has already picked up. This is reflected in our high frequency data. Look at cement sales, look at auto sales, look at the high value textile exports,” Ahmad said.

While inflation was one of his biggest concerns previously, the central bank governor said the pace of price hikes had slowed to 0.7 percent last month, the lowest level in six decades.

Consumer prices in Pakistan have been backbreaking in recent years and rose 38 percent in May 2023. Pakistan’s central bank had to halve its interest rate to 12 percent since June last year to tame inflation in the country of more than 240 million people.

“From the current month onward, the inflation will be rising and ultimately stabilize within the target range of 5 to 7 percent [in the full year],” the central bank chief added.

Meanwhile, March 2025 data on remittances showed remittances reached $ 4.1 billion last month, a record high. In terms of growth, remittances increased by 37.3 percent and 29.8 percent on y/y and m/m basis, respectively.

Cumulatively, with an inflow of $ 28.0 billion, workers’ remittances increased by 33.2 percent during Jul-Mar FY25 compared to $ 21.0 billion received during Jul-Mar FY24.

“Remittances inflows during March 2025 were mainly sourced from Saudi Arabia ($987.3 million), United Arab Emirates ($842.1 million), United Kingdom ($683.9 million) and United States of America ($419.5 million),” the data showed.